Στρατηγική προς τα εμπρός

Προκειμένου ο Οργανισμός Juro να παραμείνει ουδέτερος και να μετριάσει τις συγκρούσεις συμφερόντων, όλες οι οικονομικές δραστηριότητες και οι λειτουργίες προϊόντων και υπηρεσιών Juro θα λειτουργούν από Μέλη του Juri που έχουν λάβει άδεια οικονομικών δραστηριοτήτων (με την επιφύλαξη του Προγράμματος Κατανομής Εσόδων Juro). Όλες οι επιχειρήσεις θα λειτουργούν σε βάση πλήρους ανταπόκρισης, ενώ εφαρμόζουν αποκλειστικά τα εργαλεία του συστήματος Juro, προωθώντας το Juro και στη συνέχεια αποδεικνύοντας τις αντίστοιχες έννοιες Juro σε σημαντική κλίμακα σε σενάρια πραγματικού κόσμου, παγκοσμίως.

Μια τράπεζα Juro Affiliate θα χρησιμοποιηθεί από Μέλη των Juri, Juro Affiliates, των Juro Neutral Marketplaces και Juro Funds για τη φύλαξη, την εκκαθάριση και τις τραπεζικές υπηρεσίες που σχετίζονται με τις αντίστοιχες επιχειρήσεις.

Οι ανάγκες τραπεζικής και εκκαθάρισης παγκόσμιας θεματοφυλακής της Juro θα διεκπεραιώνονται μέσω μιας τράπεζας θυγατρικών της Juro με την ονομασία «Juro Bank», η οποία έχει διαμορφωθεί μέσω μιας παγκόσμιας στρατηγικής συγχωνεύσεων και εξαγορών από τη Juro Financial Inc αυτή τη στιγμή. Τα υποκαταστήματα και οι θυγατρικές για συγκεκριμένες δικαιοδοσίες ή/και οι αντίστοιχες τραπεζικές σχέσεις θα δημιουργούνται ως οικονομικά και στρατηγικά κατάλληλα και σύμφωνα με τα υφιστάμενα ρυθμιστικά κιγκλιδώματα (και εποπτεύονται από τις αντίστοιχες ρυθμιστικές αρχές σε όλο τον κόσμο που έχουν τη δικαιοδοσία του θέματος). Juro Financial Inc

Η Juro Financial Inc, με έδρα στο Ουαϊόμινγκ, σε συνεργασία με την Juro Funds LLC με έδρα στο Ουαϊόμινγκ, και η Juro Inc, με έδρα τη Νεβάδα, βρίσκονται στη διαδικασία ίδρυσης της μόνιμης παγκόσμιας bad bank και ειδικών χρηματοπιστωτικών ιδρυμάτων αποθετηρίου για τα οποία ζητείται η Juro Organization Trust Deed και η Juro White Paper. Σε πολλές δικαιοδοσίες, οι απαιτήσεις αδειοδότησης και εξουσιοδότησης για τις προγραμματισμένες δραστηριότητες της διαρκούς παγκόσμιας κακής τράπεζας είναι ασαφείς, επομένως οι δραστηριότητες θα ξεκινήσουν στις δικαιοδοσίες όπου η εν λόγω αδειοδότηση και εξουσιοδότηση είναι σαφείς.

Για το λόγο αυτό, ο όμιλος Juro Banks™ και χρηματοπιστωτικών ιδρυμάτων θα συσταθούν ως ελεγχόμενα χρηματοπιστωτικά ιδρύματα με λειτουργικές μονάδες δεόντως αδειοδοτημένες στις αντίστοιχες δικαιοδοσίες ή θα βασίζονται στη χορήγηση αδειών και στην εξουσιοδότηση ή/και θα βασίζονται σε τυχόν εξαιρέσεις που σχετίζονται με τις δραστηριότητες. Τα χρηματοπιστωτικά ιδρύματα θα είναι ο παγκόσμιος θεματοφύλακας και ο πάροχος υπηρεσιών ασφαλείας που συμμορφώνεται με το Juro και ο δανειστής των Μελών του Juri. αλληλογραφία μεταξύ τους και παροχή υπηρεσιών αντιπροσώπων για την ομάδα στις δικαιοδοσίες στις οποίες δραστηριοποιούνται τα Μέλη του Juri.

Τα προγραμματισμένα ιδρύματα θα λαμβάνουν καταθέσεις και θα διεξάγουν άλλες παρεμπίπτουσες δραστηριότητες, συμπεριλαμβανομένης της διαχείρισης καταπιστευματικών περιουσιακών στοιχείων, της φύλαξης, της εξυπηρέτησης χρέους / περιουσιακών στοιχείων και συναφών δραστηριοτήτων. Τα χρηματοπιστωτικά ιδρύματα Juro θα επικεντρωθούν σε μεγάλο βαθμό στη φύλαξη φυσικών εμπορευμάτων (π.χ. χρυσό και ασήμι καλής παράδοσης), νομικά έγγραφα (τίτλοι ιδιοκτησίας και πιστοποιητικά), ψηφιακά βιβλία, ψηφιακά αρχεία και εφεδρικά αντίγραφα ασφαλείας (π.

Τα χρηματοπιστωτικά ιδρύματα Juro θα εστιάζονται επίσης στην αποθήκευση περιουσιακών στοιχείων, τη διαχείριση καταπιστευμάτων, τη διεξαγωγή ποικίλων συναλλαγών με περιουσιακά στοιχεία και την παροχή «on/off» ράμπας σε αγορές τίτλων, αγορές εμπορευμάτων και τραπεζικούς λογαριασμούς πελατών εντός του πεδίου εφαρμογής των τυπικών τιτλοποιήσεων των κεφαλαίων πολλαπλών σειρών που προσφέρονται από Juro Funds ή σχετιζόμενες με την Juro Funds of LLffiliits. του Juri.

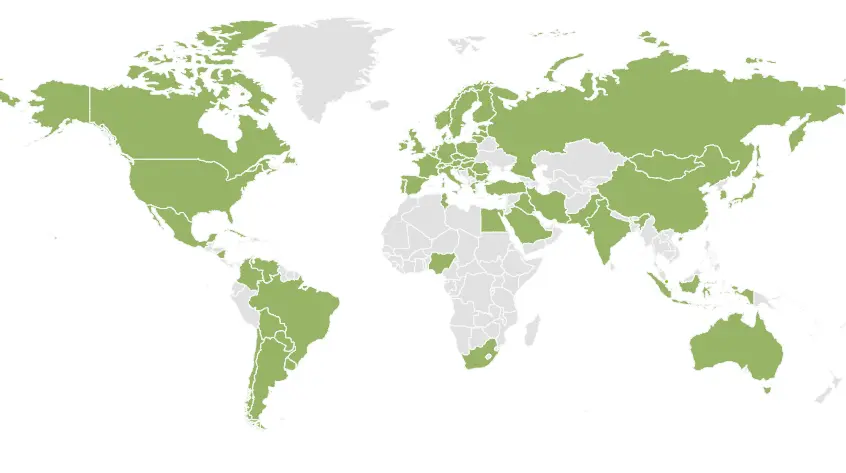

Η Juro Financial Inc θα ιδρύσει μια θυγατρική που ανήκει εξ ολοκλήρου για τους σκοπούς της λειτουργίας του παγκόσμιου δικτύου χρηματοπιστωτικών ιδρυμάτων και παρόχων υπηρεσιών που συμμορφώνονται με τη Juro. Τα κεντρικά γραφεία των προγραμματισμένων θυγατρικών μπορεί να έχουν την έδρα και την άδεια σε οποιαδήποτε πολιτεία ή επικράτεια οποιασδήποτε χώρας-μέλους UNIDROIT ή εναλλακτικά σε κράτος μέλος της Σύμβασης Apostille, αν και το Wyoming στις Ηνωμένες Πολιτείες της Αμερικής έχει προσδιοριστεί ως η προτιμώμενη δικαιοδοσία για τα κεντρικά γραφεία.

Υποκαταστήματα και θυγατρικές των χρηματοπιστωτικών ιδρυμάτων Juro ανοίγουν σε οποιεσδήποτε άλλες δικαιοδοσίες ή χώρες, όπου χρειάζεται και όπου απαιτείται. Τα χρηματοπιστωτικά ιδρύματα Juro θα χρησιμοποιούν επίσης τις υπηρεσίες άλλων παγκόσμιων θεματοφύλακες και υποθεματοφύλακες που είναι Μέλη του Juri, όπως και όπου χρειάζεται.

Η εφαρμογή αυτής της στρατηγικής θα μας βοηθήσει να Κάνουμε τη Γη Ξανά Δίκαιη™!

Επιχείρηση μέσα σε επιχείρηση

Ξεκινήστε μια νέα επιχείρηση χρησιμοποιώντας τα τυποποιημένα προϊόντα, υπηρεσίες και μοντέλα αποζημίωσης του Οργανισμού Juro. Ή, προσθέστε ροές εσόδων στην υπάρχουσα επιχείρησή σας, προσφέροντας τα μοναδικά και ελκυστικά προϊόντα και υπηρεσίες της Juro.

Είστε deal maker; Είστε επαγγελματίας χρηματοοικονομικών υπηρεσιών; Ενδιαφέρεστε να εκπαιδευτείτε για να γίνετε κερδοφόρος Juro Deal Originator;

Εάν θέλετε να δείτε περισσότερες πληροφορίες σχετικά με επιχειρηματικές ευκαιρίες που είναι διαθέσιμες αυτήν τη στιγμή, ζητήστε πληροφορίες από την Juro Financial Inc, την οντότητα με την άδεια αποκλειστικής οικονομικής εκμετάλλευσης από το καταστατικό ίδρυμα του οργανισμού Juro. business opportunities | Juro Financial Inc