未来战略

为了使 Juro 组织保持中立并减少利益冲突,所有经济活动以及 Juro 产品和服务的运营都应由已获得经济活动许可证的 Juri 成员运营(须遵守 Juro 收入分享计划)。所有业务都应在公平的基础上运营,同时专门实施 Juro 系统的工具,推广 Juro,并随后在全球范围内在现实世界中大规模证明各自的 Juro 概念。

Juro 附属银行将被 Juri、Juro 附属机构、Juro 中立市场和 Juro 基金的成员用于与各自业务相关的托管、清算和银行服务。

Juro 的全球托管银行业务和清算需求将通过 Juro 的附属银行“Juro Bank”处理,该银行目前正在由 Juro Financial Inc. 通过全球并购战略组建。分支机构、特定司法管辖区的子公司和/或代理银行关系的设立应在经济和战略上合理,并符合现有监管规定(并接受全球相关监管机构的监管)。 Juro Financial Inc

Juro Financial Inc(注册地为怀俄明州)与 Juro Funds LLC(注册地为怀俄明州)以及 Juro Inc(注册地为内华达州)正在建立永久性全球坏账银行和特殊存款金融机构,这是 Juro 组织信托契约和 Juro 白皮书中所要求的。在一些司法管辖区,永久性全球坏账银行计划活动的许可和授权要求并不明确,因此,相关运营应在上述许可和授权明确的司法管辖区开始。

因此,Juro Banks™ 集团和金融机构应作为受监管的金融机构成立,其运营单位应在各自的司法管辖区内获得正式许可,或者应依赖许可证和授权的通行证,和/或应依赖与活动有关的任何豁免。金融机构将成为符合 Juro 标准的全球托管人和安全服务提供商,以及 Juri 成员的贷款人;相互对应并在 Juri 成员运营的司法管辖区内为集团提供代理服务。

计划中的机构将接收存款并开展其他附带活动,包括信托资产管理、托管、债务/资产服务及相关活动。Juro 金融机构将重点关注实物商品(即可交割黄金和白银)、法律文件(所有权证书)、数字账本、防灾数字档案和备份(即防范太阳耀斑)、传统资产、补充货币、虚拟货币、数字证券和实用代币的托管。

Juro 金融机构还应专注于存储资产、信托管理、进行各种资产交易以及在 Juro Funds LLC 或 Juro 附属公司提供的多系列基金标准证券化范围内以及 Juri 成员的任何相关证券化范围内提供证券市场、商品市场和客户银行账户的“开/关”通道。

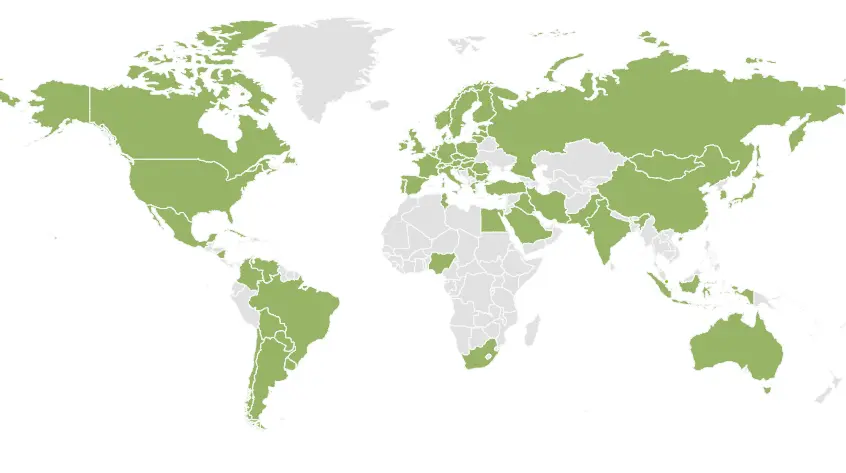

Juro Financial Inc 将设立一家全资子公司,负责运营符合 Juro 标准的金融机构和服务提供商的全球网络。计划中的子公司的总部可以设在任何国际统一私法协会成员国的任何州或地区,或者海牙认证公约成员国,但美国怀俄明州已被确定为总部的首选司法管辖区。

Juro 金融机构应在适当和需要时在任何其他司法管辖区或国家开设分支机构和子公司。Juro 金融机构还应根据需要聘用属于 Juri 成员的其他全球托管人和次级托管人。

实施这一战略将帮助我们让地球再次变得公正™!

企业中的企业

利用 Juro 组织的标准化产品、服务和薪酬模式,开启新业务。或者,通过提供 Juro 独特且极具吸引力的产品和服务,为您现有的业务增添收入来源。

您是交易撮合者吗?您是金融服务专业人士吗?您是否有兴趣接受培训,成为一名能够创造利润的 Juro 交易发起人?

如果您想了解更多有关当前可用的商业机会的信息,请向 Juro Financial Inc 索取信息,该公司是 Juro 组织法定基金会颁发的独家经济开发许可的实体。 business opportunities | Juro Financial Inc